- Market Info

Interest in France remained high for Nordic investors in 2020

The 2020 annual report on foreign investment in France shows that, while 2020 was marked by an unprecedented crisis, France performed well in terms of foreign investment. For several years now, France has improved its performance and has become the leading host country for foreign direct investment in Europe in 2019. The Nordic countries continue to play an important role in the French economy, contributing to its successes in 2020 by investing in key-sectors targeted by the French recovery plan.

2020, a symbol of France’s attractiveness

Against the backdrop of a global slowdown in investment due to the COVID-19 crisis, 1,215 investment decisions were made in France in 2020, down 17% from 2019. Over 80% of these projects helped maintain or create jobs in France, even though this type of investment is down 33% worldwide.

In total, these investments supported 34,567 jobs. While this number is down 13% compared to 2019, it is up 14% compared to 2018. In terms of foreign investments in France, this makes 2020 the second-best year in a decade!

Figure 1: Change in project and job numbers (2014-2020)

These investment projects continue to confirm France’s attractiveness and the relevance of the reforms engaged in the last years. The French stimulus plan of €100 billion was set up to counter the effects of the pandemic. But it is also designed to create the France of 2030 by investing massively in strategic sectors, such as the ecological and digital transitions, health, the 4.0 industry or R&D and innovation, where the Nordic countries have a major role to play.

With 71 new investment decisions in 2020 and 75 if we include 4 projects from the Baltic States, the Nordic investments illustrate the attractiveness of France and the efficiency of the structural reforms that have been implemented for several years. 2020 is the second-best year for Nordic investment projects!

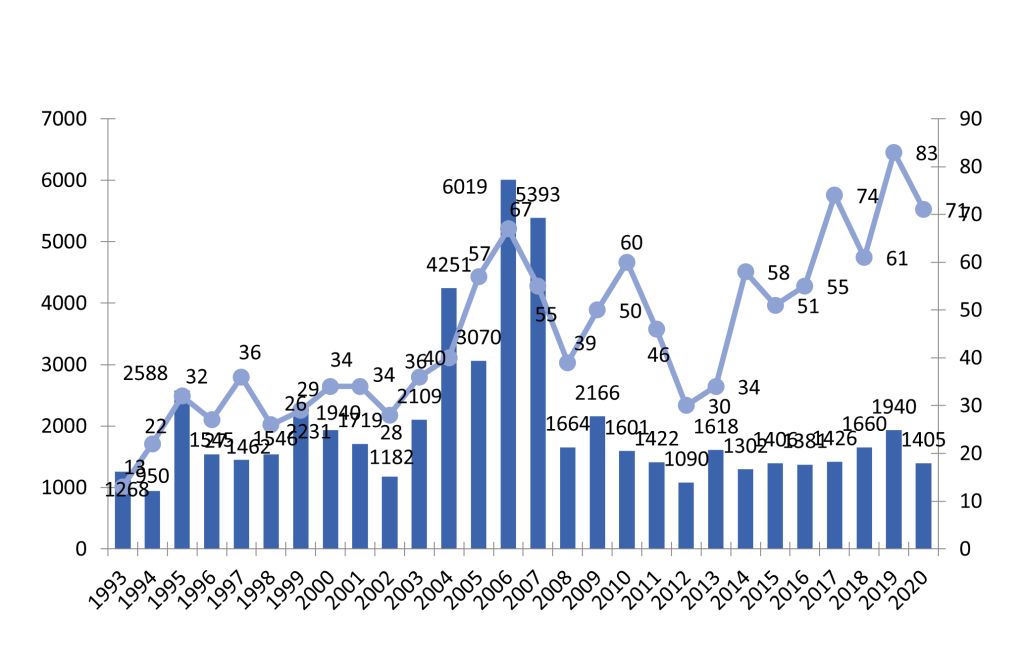

Figure 2: Number of jobs and projects created or maintained, 1993-2020 Nordic countries

A new record year for Danish investments in France!

30 new Danish investments have been decided in 2020, strengthening the clear and strong dynamic between Denmark and France.

The Health sector, one of the pillars of the French recovery plan, is particularly highlighted by major investments from Danish companies. As an example, the pharmaceutical company Leo Pharma has announced an investment of €39 million in its French site, resulting in the creation of 80 jobs.

While the French stimulus plan aims to decarbonize the industry, Danish companies are standing out in this area by investing in improving their environmental performance. This is the case of Novo Nordisk, which has invested €164 million in its Chartres site, with the aim of making it carbon neutral and thus accelerating the group’s energy transition.

Read more: Danish investments in France hit a new record in 2020

Sweden continues its momentum

To date, more than 450 Swedish companies are established in France and employ more than 95,000 people. In 2020, Sweden has strengthened its position, investing in 30 projects and creating 658 jobs.

Swedish investments were primarily directed to the pharmaceutical and biotechnology sector, where five large-scale investment projects have been decided. The importance of this sector in 2020 is in line with the objectives set out in the French stimulus plan: its competitiveness axis targets health as one of its five strategic sectors for investments.

The Swedish pharmaceutical company Recipharm has signed a contract with Moderna for the formulation of their COVID-19 vaccine, based on an innovative messenger RNA technology. The Swedish group has also decided to build additional production capacity in order to meet recurrent demands for vaccines against viral pandemics. This investment reaches a total estimated amount of €60 million and will allow the creation of 100 jobs on the site.

The Swedish group Ericsson has announced the opening of its first R&D center in France, in Massy, within the Paris-Saclay competitiveness cluster. This R&D center, dedicated to 5G software and security, aims to accelerate the 5G dynamic in Europe and will be able to accommodate up to 300 researchers and engineers. This promising investment is in line with France’s ambitions to develop national solutions around telecoms and to obtain end-to-end control of these solutions.

Besides the stimulus plan, these good results are also backed by the French-Swedish partnership for innovation and green solutions.

Read more: Focus on Swedish investment in France in 2020

French resilience explained

As soon as the global health crisis linked to Covid-19 occurred, new measures were implemented in France. On the one hand, they aimed to temporarily support the sectors of the economy most affected by the pandemic, and on the other hand they strived to design French strategy for recovery within the framework of the economic recovery plan “France Relance”.

The national strategy is based on four main areas of transformation: a new fiscal environment, the transformation of the social model, administrative simplification coupled with the facilitation of industrial locations, and the acceleration of the ecological transition:

- Promoting investment and employment through a new fiscal environment;

- Transforming the French social model towards greater flexibility and competitiveness;

- Offer companies a simplified administrative environment and incentives to encourage innovation, job creation and new locations;

- Accelerating the ecological transformation and affirming the choice of a pioneering economy in industrial decarbonization.

Furthermore, numerous pro-business reforms have been implemented in France since 2017. They are solid assets that will enable France, and the businesses developing there, to tackle the post-crisis rebound from 2020 with greater agility.

Due to these results, France’s forecast is good for 2021, with the strongest growth in Europe, and one of the strongest performances among the countries compared of 5.9%, ahead of the United Kingdom (5.1%) and Germany (3%).

As stated by Business France Annual Report 2020, “in a context of a sharp decline in investments, where uncertainty weighs heavily on the global economy, France has shown resilience. The crisis interrupted the positive momentum of 2019 but has not challenged the attractiveness of France for investment.”

There appears to be renewed confidence in France as an investment location: 90% of executives of foreign businesses set up in France draw a positive impression of their investment in France. Moreover, 48% of them believe that their presence in France has tended to expend, 42% of them that it has stayed the same, versus only 10% who believe it has diminished.

Contact us for more information or for free guidance in your investment project in France.

Article written by Sara Chollet