- Market Info

Reindustrializing France: why the bicycle industry is promising

As Denmark is preparing the Grand Depart of the Tour de France 2022 on July 1st from Copenhagen, we wanted to emphasize the importance of the bicycle industry in France. A promising sector and an area of expertise to which the Nordic countries could contribute with their knowledge and skills.

The bicycle industry is growing in France: €3 billion in sales

If one sector is not in crisis in France, it is the bicycle industry, due to the strong growth in bicycle travel, accentuated after covid-19 lockdowns. 2.8 million bicycles were sold in 2021, of which nearly a quarter were electric bikes, for which demand is exploding. Of this amount, 800,000 cycles were manufactured in France.

The result: more than €3 billion in sales in France last year for the combined sales of bikes, peripherals, and accessories. The question is whether this boom is fully benefiting the French industry.

By comparison, Portugal is the leader in bicycle production, with nearly 3 million bicycles produced in 2021. In contrast, in 2010, it made the same volume of bicycles as France today. Across Europe, sales could approach 30 million units sold, according to projections, representing a 47% increase over current levels.

Read more: Which electric mobilities in France in 2022?

A specialized industrial sector in search of new talent

The bicycle economic sector is promising, both from an industrial and a service point of view. A study by Ademe in April 2020 estimates that the number of direct jobs in the sector [in the broadest sense, from manufacturing to tourism and repair] already stands at 78,000. In 2030, the potential job pool is estimated at 150,000 and 300,000 jobs.

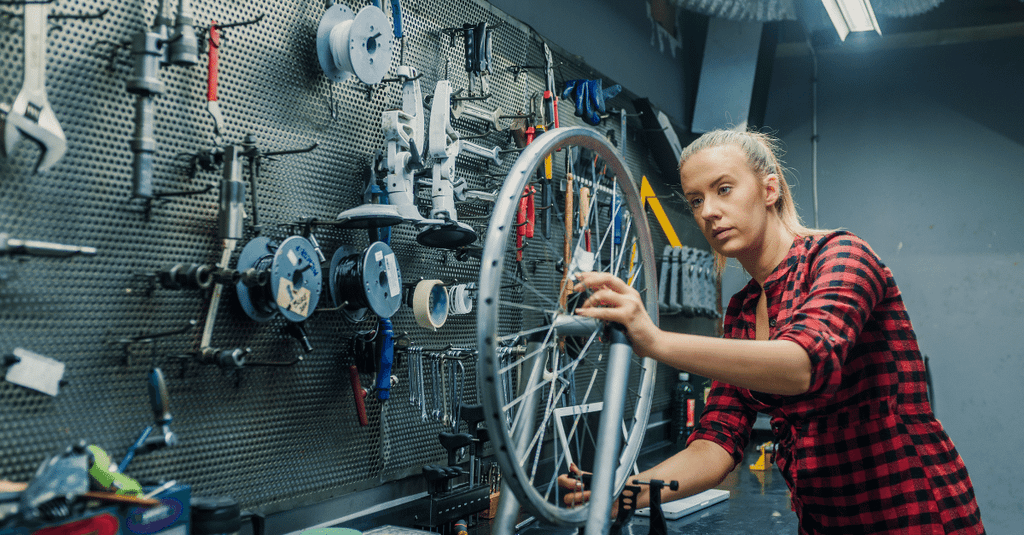

To achieve this, in May 2020, the Ministry of Ecological Transition released a budget of €8 million for 2020-2022 to create an Academy of Bicycle Professions aimed at certifying 500 bicycle mechanics each year.

Read more: Norske Skog’s CEO chose France to invest in a greener industry

A market that is adapting to new metamorphoses in mobility

To support the development of the bicycle industry, a list of priority measures has been drawn up by a parliamentary mission. It is based on two convictions:

- France must target its business segments and succeed in expanding into the mid-range and high-end technology markets. The revolutions in electrically assisted bicycles, cargo bikes, and connected objects represent real opportunities for manufacturers in France.

- France must develop bridges and partnerships between the various industrial and economic sectors. In concrete terms, players in the bicycle, automobile, aeronautics, electronics, screw-cutting, and French Tech sectors must work together.

Bicycle industry: in the saddle for the quarter-hour society!

For example, just a year ago, Smoove, a mobility operator – known for managing the Vélib in Greater Paris as part of the Smovengo consortium – and Zoov, a specialist in shared electric bicycles, joined forces to address new markets and face competition. The joint venture has just been renamed Fifteen, like the “quarter-hour city” (all essential services are within a quarter-hour walk or bike ride) that it wants to help implement.

The startup believes that next-generation bicycle services, designed with the requirements of entire transportation networks and augmented by technology, will make this vision a reality. These ambitious projects are accompanied by the recruitment of some 60 people in Paris and Lyon in all business areas, from design to marketing bicycle services to local authorities and mobility operators. Fifteen has 140 employees to date.

Read more: What’s happening with La French Tech in 2022?

So, contact us for free guidance on your investment projects in France!

Article written by Samy Trabelsi